As one of Canada’s largest and most dynamic cities, Toronto has consistently attracted homebuyers, investors, and immigrants, contributing to the city’s robust housing market. Over the past few years, the Toronto housing market has experienced significant fluctuations, driven by a combination of economic factors, governmental interventions, and supply-demand imbalances.

As we approach 2025, the outlook for Toronto’s housing market remains a hot topic for investors, policymakers, and potential homeowners. In this article, we will explore the key trends and predictions for the Toronto housing market in 2025, considering economic, social, and regulatory developments.

1. Current Market Overview and Recent Trends

Before looking into the future, it’s important to understand the current state of Toronto’s housing market. In 2023 and 2024, the market experienced volatility, driven by:

- Interest Rate Hikes: The Bank of Canada raised interest rates to curb inflation, increasing borrowing costs. This caused a cooling effect on housing prices as buyers faced higher mortgage payments.

- Supply Shortages: Toronto has long struggled with a limited supply of new housing developments, particularly in affordable housing and entry-level homes. The demand for housing continues to outpace supply, driving up prices.

- Immigration Boom: Toronto’s growing population, fueled by increased immigration targets, has contributed to a continuous demand for housing, despite economic challenges.

- Shift to Suburban Areas: Post-pandemic trends showed a growing preference for suburban and exurban areas, as remote work allowed more flexibility in housing choices, putting downward pressure on urban condo prices.

2. Key Factors Shaping the Toronto Housing Market in 2025

As we look toward 2025, several factors are expected to shape the housing market in Toronto:

a) Interest Rate Stabilization

While the aggressive interest rate hikes in 2023 and 2024 slowed the housing market, many analysts predict that the Bank of Canada will likely stabilize or even lower rates by 2025 as inflation comes under control. This could reignite demand in the housing market, especially among first-time buyers who were priced out due to high borrowing costs. Lower interest rates will make mortgages more affordable, leading to a potential surge in both property sales and housing prices.

b) Government Policy and Regulatory Changes

- Increased Housing Supply Initiatives: The Ontario government has set ambitious targets to build 1.5 million homes by 2031, a significant portion of which is expected in the Greater Toronto Area (GTA). If these targets are met, we may see an easing of supply constraints, potentially cooling the rapid price increases in 2025.

- Foreign Buyer Policies: The current foreign buyer ban, enacted in 2023, is set to expire by 2025. Whether or not the policy is renewed or relaxed will play a major role in determining demand, particularly in the luxury condo market, which is heavily influenced by international investors.

- Affordable Housing and Rental Market Policies: With increasing concern about affordability, governments may introduce new measures to support affordable housing developments or provide rental assistance. Any policy shifts here could impact both home prices and rental demand in 2025.

c) Immigration and Population Growth

The federal government’s immigration targets are set to bring in over 500,000 new immigrants annually by 2025, many of whom will settle in major urban centers like Toronto. This population growth will likely put further pressure on the housing market, particularly in the rental sector, driving demand for both condos and rental properties in key urban areas.

d) Urban Development and Infrastructure Projects

Several large-scale infrastructure projects, including transit expansions such as the Ontario Line subway, are expected to be completed or near completion by 2025. These projects are expected to boost property values in neighborhoods with improved transit access. Areas surrounding new transit hubs and infrastructure upgrades will likely see a rise in real estate activity as these projects make commuting more convenient.

7 Canadian Cities Poised for Real Estate Growth

Calgary Housing Market Forecast 2024, 2025, 2026 & 2030

Canada Housing Benefit 2024: Who is Eligible for $500 & How to Apply?

Oakville Housing Market Prediction for 2025: Trends & Visual Forecast

Bank of Canada Interest Rate Announcement, Forecast & Latest Updates

3. Predictions for the Toronto Housing Market in 2025

Given the factors at play, here are some key predictions for 2025:

a) Housing Prices to Stabilize, Followed by Moderate Growth

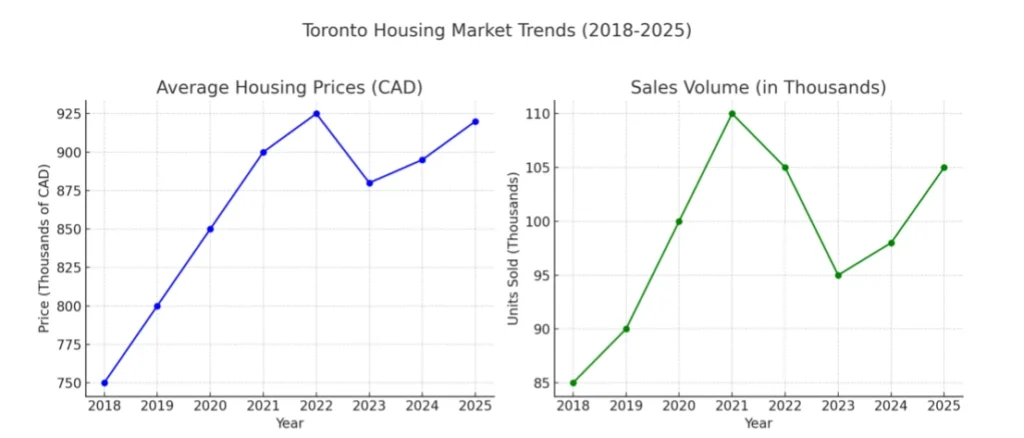

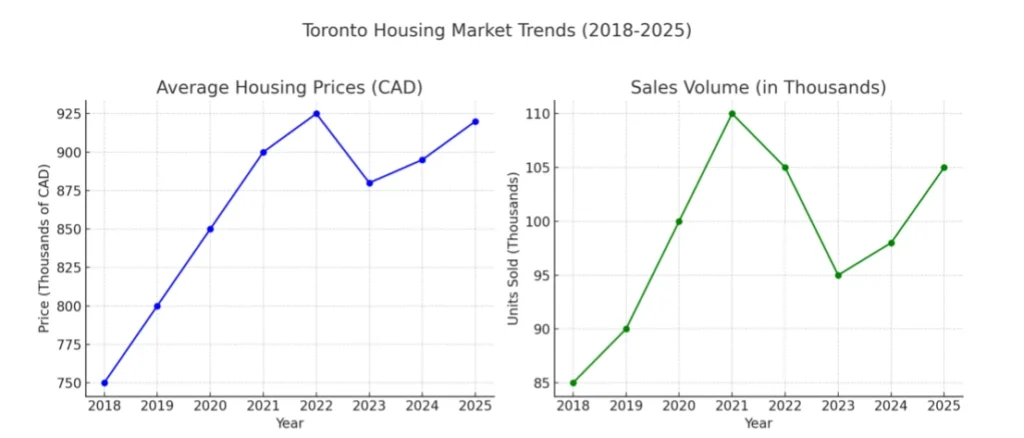

- Price Trends: After a cooling period in 2023 and 2024 due to higher interest rates, the housing market in Toronto is expected to stabilize by mid-2025. Prices are likely to show moderate growth, fueled by renewed demand, but will not return to the explosive price hikes seen in the early 2020s.

- Average Home Price Projections: The average home price in Toronto is forecast to grow by 3% to 5% in 2025, with the condo market seeing slightly lower growth due to a potential oversupply from new developments. Detached homes and suburban properties may see stronger growth due to sustained demand for more spacious housing.

b) Increased Demand for Rental Properties

- Rental Market: With immigration continuing to boost population growth, rental demand is likely to rise sharply in 2025. This is particularly true for newcomers who may not be able to afford homeownership immediately. As a result, rental prices could increase by 6% to 8% in key areas, particularly in downtown Toronto and neighborhoods close to transit lines.

- Condo Rental Market: The condo rental market is expected to be a significant beneficiary of this demand. As many developers continue to build high-rise residential units, investors looking for rental income may focus on purchasing these properties to capitalize on high rental yields.

c) Emerging Neighborhoods and Suburban Growth

Suburban and exurban areas around Toronto, such as Hamilton, Oshawa, and Barrie, will continue to grow in popularity as homebuyers seek more affordable options outside the city core. These regions are expected to see higher price appreciation compared to central Toronto due to increased demand and infrastructure improvements that make commuting more convenient.

d) Sustainability and Green Building Demand

Toronto’s housing market in 2025 may also see an increase in demand for eco-friendly homes, particularly those built with energy-efficient technologies. Buyers are becoming increasingly conscious of environmental impact and long-term cost savings, prompting developers to incorporate more sustainable features in new builds.

4. Challenges and Risks to Watch For

Despite these optimistic projections, several risks could disrupt the Toronto housing market in 2025:

- Economic Slowdown: If the Canadian economy experiences slower-than-expected growth or a recession, the housing market could face reduced demand, causing prices to stagnate or even decline.

- Continued Supply Shortages: Even with the government’s aggressive targets, if housing supply does not keep pace with demand, prices could skyrocket once again, exacerbating affordability issues.

- Mortgage Defaults: Higher interest rates from previous years may lead to an increase in mortgage defaults if homeowners struggle to keep up with rising costs. This could introduce downward pressure on prices if distressed sales increase.

Toronto’s Housing Market in 2025 – A Year of Recovery and Moderation

While the Toronto housing market will face challenges such as supply shortages and affordability concerns, 2025 is expected to be a year of recovery and moderation. Stabilizing interest rates, continued population growth, and infrastructure development will likely support moderate price growth and sustained demand. However, policymakers must continue to address the housing supply gap and affordability crisis to ensure the market remains accessible for all. Whether you’re a first-time buyer, investor, or renter, staying informed of market trends will be key to navigating Toronto’s real estate landscape in 2025.