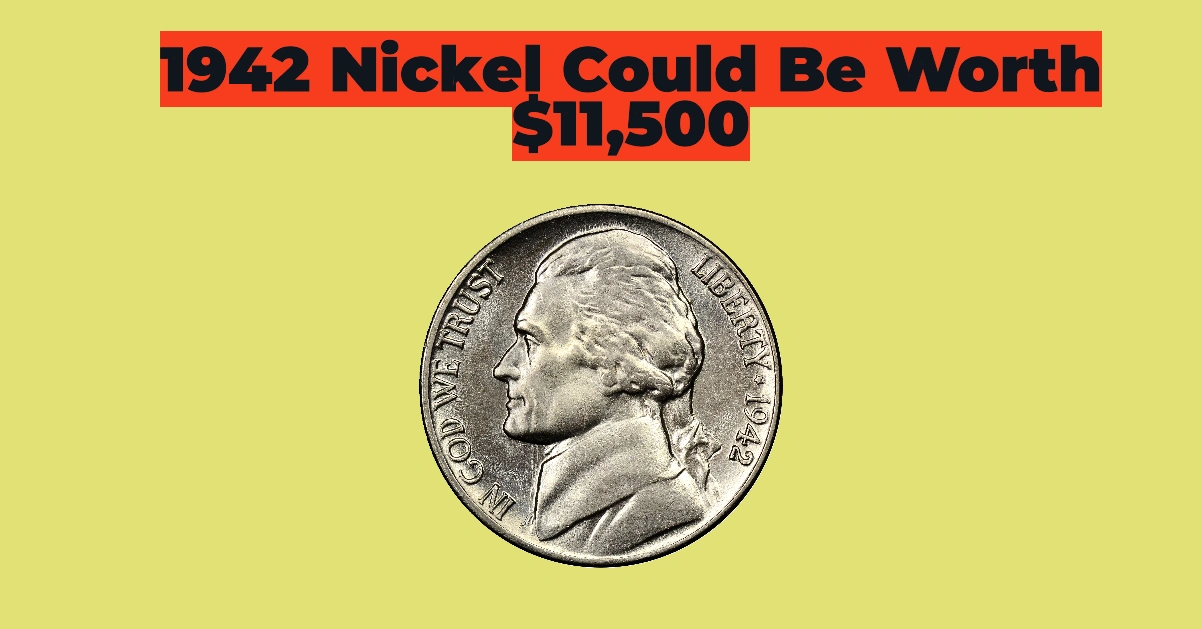

Many people overlook the value of the spare change in their pockets. But if you happen to have a 1942 Jefferson Nickel, you could be sitting on a small fortune. Some rare variations of this coin have sold for as much as $11,500 at auction! Why Is the 1942 Nickel So Valuable? The U.S. Mint Continue reading

IRS Stimulus Check 2025: How to Claim Your $1,400 Payment Before the Deadline

The IRS stimulus check 2025 is providing financial relief to eligible American citizens, ensuring that extra payments continue reaching households across the country. If you haven’t yet claimed your stimulus check, it’s crucial to understand the eligibility criteria, deadlines, and how to apply before the final cut-off date. What Is the IRS Stimulus Check 2025? Continue reading

SSDI March 2025 Payment Schedule: Exact Dates and Eligibility for Your Social Security Disability Benefits

The Social Security Disability Insurance (SSDI) payments for March 2025 are on their way, ensuring financial stability for millions of eligible Americans. If you’re wondering when you will receive your SSDI check this month, it’s crucial to understand the exact payment schedule. The Social Security Administration (SSA) follows a structured system to distribute these payments Continue reading

Stimulus Check Payments March 2025: What Payments Can You Expect This Month?

With the arrival of March 2025, many Americans are eagerly anticipating their next round of Stimulus Check Payments March 2025. These payments serve as financial lifelines for low-income families, middle-class taxpayers, and state residents who qualify for specific aid programs. This month, three major stimulus programs stand out, providing direct deposits and relief checks to Continue reading

Child Tax Credit 2025: Who Qualifies for the IRS Credit for Other Dependents?

Millions of taxpayers in the United States may be eligible for a special tax break under the Child Tax Credit 2025 program. While the Child Tax Credit (CTC) and Additional Child Tax Credit (ACTC) provide financial relief for parents with qualifying children, those with dependents who don’t meet CTC criteria can still benefit from the Continue reading

Big Lots and Dollar Tree Closure 2025: Over 1,500 Stores Shutting Down in Retail Apocalypse

The retail sector is facing yet another crisis, with Big Lots and Dollar Tree closures in 2025 marking one of the most significant shutdowns in recent history. Over 1,500 stores are set to close their doors as both chains struggle with underperformance, rising costs, and strategic missteps. Dollar Tree Shutting Down Over 1,000 Stores Amid Continue reading

Retroactive Social Security Payments of $6,710 Begin – Millions of Americans Set for Historic Boost

Millions of Americans are now receiving long-overdue retroactive Social Security payments, thanks to the Social Security Fairness Act, a groundbreaking law aimed at eliminating unfair reductions in benefits. The new legislation, which officially repeals the Windfall Elimination Provision (WEP) and Government Pension Offset (GPO), has already resulted in over $7.5 billion in payments, with each Continue reading

Wells Fargo Sues JPMorgan Over Alleged $481M Real Estate Loan Fraud – What Investors Need to Know

In a high-stakes legal showdown, Wells Fargo (WFC) has filed a lawsuit against JPMorgan Chase (JPM), accusing the banking giant of knowingly backing a fraudulently inflated $481 million commercial real estate loan. The lawsuit, filed in Manhattan federal court, alleges that JPMorgan disregarded clear signs of financial misrepresentation in its rush to secure fees—leading to Continue reading

T-Mobile Customers Can Get Up to $25,000 from Data Breach Settlement – Check If You Qualify

If you were a T-Mobile customer in August 2021, you may be entitled to a significant payout from a $350 million settlement following a major data breach. Affected customers who filed claims before the deadline could receive up to $25,000 in compensation, with payments set to begin in April 2025. Here’s everything you need to Continue reading

Who Can Apply for the Child Tax Credit in 2025? Eligibility Rules, Income Limits & How to Maximize Your Refund

The Child Tax Credit (CTC) in 2025 remains a valuable financial boost for millions of American families, helping to offset the costs of raising children. However, not everyone qualifies, and the IRS has set specific eligibility criteria, income thresholds, and residency requirements for taxpayers looking to claim this credit for the 2024 tax year (filed Continue reading